At the start of the year, we wrote a piece about the fact that MGM Resorts had offered $11 billion to buy the British gambling company Entain. Nothing came of that offer in the end, with DraftKings now stepping up to the place and offering $20 billion for the parent company of the likes of Ladbrokes, Coral and PartyPoker. Interestingly, MGM Resorts and Entain already have a partnership in place over certain US-based interests, meaning that MGM will get a say in the outcome of any deal that is struck to buy Entain by DraftKings.

At the start of the year, we wrote a piece about the fact that MGM Resorts had offered $11 billion to buy the British gambling company Entain. Nothing came of that offer in the end, with DraftKings now stepping up to the place and offering $20 billion for the parent company of the likes of Ladbrokes, Coral and PartyPoker. Interestingly, MGM Resorts and Entain already have a partnership in place over certain US-based interests, meaning that MGM will get a say in the outcome of any deal that is struck to buy Entain by DraftKings.

Prior to new about the deal breaking this week, Entain’s ‘enterprise value’ stood at around £13.2 billion, which is roughly $18 billion. The offer that DraftKings are rumoured to have made is largely in the form of DraftKings stock, in addition to a degree of cash. It could prove to be a massive deal for the ever-developing betting market in the United States of America, given both the reputation of DraftKings and the place that Entain holds in the British market. We don’t yet know whether DraftKings are just after the US business.

Update 26/10/21: DraftKings Withdraw Entain Offer

DraftKings have walked away from the deal to purchase Entain, well ahead of their 16th November deadline. Although no reason has been given for the deal falling through, it is thought that Entain’s existing agreement with rival firm MGM could have been a stumbling block in discussions.

What Happened In January

In January of 2021, MGM Resorts made an all-stock bid of $11 billion for Entain. Many believed that the offer might well be accepted, based on the fact that Entain and MGM already had a business arrangement in the form of BetMGM. The bid from MGM Resorts came not long after Caesars Entertainment had made a £2.9 billion move to take over William Hill, with William Hill already having a stake in the US betting market. Caesars Entertainment were quite clear about only being interested in that side of the business.

In January of 2021, MGM Resorts made an all-stock bid of $11 billion for Entain. Many believed that the offer might well be accepted, based on the fact that Entain and MGM already had a business arrangement in the form of BetMGM. The bid from MGM Resorts came not long after Caesars Entertainment had made a £2.9 billion move to take over William Hill, with William Hill already having a stake in the US betting market. Caesars Entertainment were quite clear about only being interested in that side of the business.

The bid from MGM Resorts was rejected by Entain, with the gambling behemoth suggesting that it undervalued its worth. The stock market moves around the bid seemed to be indicating that investors believed that MGM would return with a higher bid, but that never materialised. Now it appears as if another one of the American betting giants has decided to fill the void left by MGM’s lack of movement, so it will be interesting to see whether or not that encourages MGM back into the market to gazump their rivals.

What The DraftKings Move Looks Like

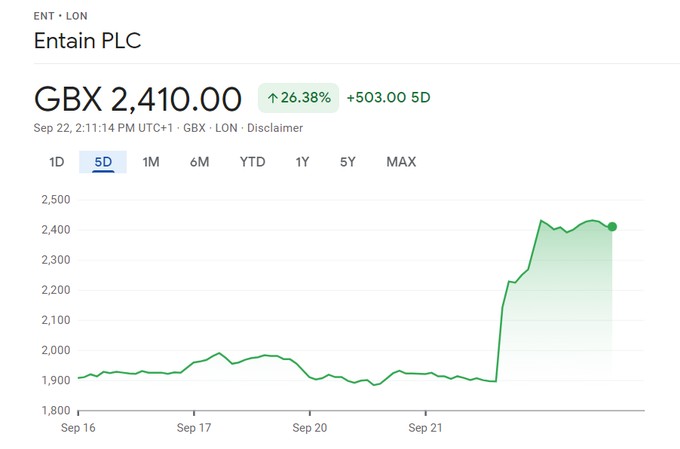

If DraftKings are hoping to fill the void left by MGM then they’ve moved at the right time to do so. Entain’s share price jumped by around 18% when news of the deal leaked, whilst DraftKing’s dropped by 7.4%. Entain’s board confirmed that it had received a proposal for a takeover in a filing with the London Stock Exchange, but there was no information about the price in the release. Instead, shareholders were urged to ‘take no action at this time’ and were told that a ‘further announcement will be made as and when appropriate’.

Entain Share Price 22nd September 2021 Courtesy of Google Finance

An offer compromised of DraftKings stock and cash might well be more attractive to the Entain board than the all-stock offer of MGM Resorts. That being said, the fact that the offer values the company higher will likely be seen as a more important part of any consideration that Entain’s board gives the matter. Part of the conversation might also entail a discussion about whether or not DraftKings have sufficient market pull to mean that a deal with them makes sense for one of the UK’s biggest betting companies.

Why Do MGM Get a Say in the Deal?

An interesting twist in the plot around any deal between Entain and DraftKings comes in the form of MGM Resorts getting a say in the final outcome. The online sports betting partnership between MGM and Entain, known as BetMGM, means that there is already an agreement in place between the two companies. MGM Resorts is not involved in DraftKings’ bid for Entain, but their consent is needed before any deal can go through, thanks to the fact that it would involve a US asset of Entain that MGM is involved in.

A company statement from MGM Resorts said the following on the matter:

“Any transaction whereby Entain or its affiliates would own a competing business in the U.S. would require MGM’s consent. MGM will engage with Entain and DraftKings, as appropriate, to find a solution to the exclusivity arrangements which meets all parties’ objectives.”

Whether that contains a thinly veiled threat to Entain is unclear, but it’s certainly true that the company doesn’t seem to be delighted about the possible move. The interesting thing is that the statement refers to Entain owning a ‘competing business in the US’, whereas this deal would actually involve Entain being owned by a competing business. It is likely that MGM Resorts wants its pound of flesh and will be keen to ensure that it doesn’t lose any money or value as part of any deal that ends up being struck.

What Would Happen To Entain

The one thing that isn’t all that clear at this moment is what, exactly, would happen to Entain in the event that the deal goes through. We’ve already seen with Caesars Entertainment’s purchase of William Hill that they’ve effectively broken the business into two, with the US side of the business remaining under Caesar’s control but the European side of the company, which included the UK-based betting shops that William Hill owns. The question is, would DraftKings look to follow a similar path?

Caesars Entertainment made no bones about the fact that they wanted shut of anything other than the US-business of William Hill as quickly as possible. The information about this deal has been decidedly scant in comparison, but it is likely that DraftKings would follow a similar pattern. With the likes of Ladbrokes and Coral owning shops on the British high street, it would be much more difficult for DraftKings to simply close down the online side of the businesses that are part of Entain, to say nothing of the fact that would be a poor business decision.