Following on from the Gambling Commission’s announcement that credit cards will not be able to be used from the fourteenth of April onwards to make deposits to betting companies, the eBank Revolut has confirmed that this will include their pre-paid cards. It comes in the wake of the UKGC’s review of online gambling as well as the government’s own review into Gaming Machines and Social Responsibility Measures.

Following on from the Gambling Commission’s announcement that credit cards will not be able to be used from the fourteenth of April onwards to make deposits to betting companies, the eBank Revolut has confirmed that this will include their pre-paid cards. It comes in the wake of the UKGC’s review of online gambling as well as the government’s own review into Gaming Machines and Social Responsibility Measures.

Back in March 2019 Revolut customers were caught in confusion when some gambling transactions were being declined. This was due to anti money laundering measures however and separate to this block on credit card use.

Revolut is technically referred to as a ‘money service business’, so falls under the government’s new restrictions that has been put in place on credit card transactions in the world of gambling. It applies to non-remote general betting, pool betting and betting intermediary licences as well as all remote licences. Though the vast majority of people gamble responsibly, some do struggle with managing their finances and it is hoped this will clamp down on that.

Update 16/09/20: Revolut Now Offering Debit Cards Which CAN Be Used For Online Betting

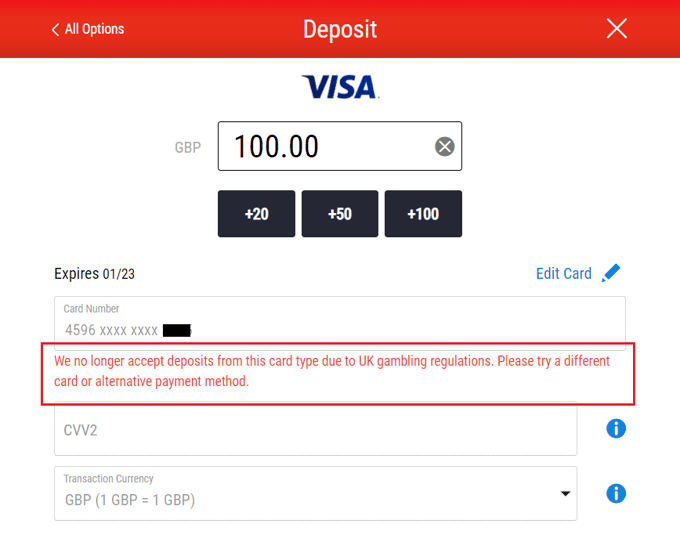

It seems that Revolut have found a way around the rules and, for the time being at least, it is possible to use Revolut for online betting. The issue came from the type of card that Revolut issued – as a pre-paid debit card gambling transactions became restricted when the new UKGC rules came in.

However, it is now possible to order a traditional debit card that is linked to your Revolut account rather than a pre-paid one. This should work the same was as any other debit card so you will be able to continue to use Revolut at the bookies if you order a new debit card.

Note: In our test transaction it initially declined but turned out to be because of a setting blocking online transactions that was automatically applied to the new card, simply enable online transactions and it should work fine.

Why The Ban Is Being Introduced

The United Kingdom Gambling Commission announced that it would be banning the use of credit cards by consumers looking to gamble. Coming into effect on the fourteenth of April 2020, the decision was based, at least in part, on a public consultation that took place between August and November 2019. Just under half of the UK’s twenty-four million gamblers do so online, with around ten and a half million fitting that brief.

UK Finance believes that around eight hundred thousand of those online gamblers use credit cards to add funds to their betting accounts, whilst the UKGC thinks that about twenty-two percent of those that add funds with credit cards would be classed as problem gamblers. There are even more people on top of that number that are ‘at risk’. It is hoped that the ban will help to reduce those figures, as well as limit the financial trouble people can get in to.

Protecting Consumers

The decision that was taken by the UKGC as well as the Department for Culture, Media and Sport in January was done so with consumers in mind. Neil McArthur, the Chief Executive of the Gambling Commission, said, “This credit card ban will further protect consumers from financial harm and…nobody in Great Britain can use a credit card to gamble. It is a ban which ultimately reduces the risks of harm to consumers from gambling with money they do not have”.

McArthur also feels that the ban is ‘another milestone’ towards keeping people safer when betting online, which has increased in popularity recently. The interest in virtual sports and online slots lately is believed to be linked to people staying at home more, so McArthur is aware of the responsibility on the UKGC and gambling operators to protect bettors as much as possible. He did say he was aware that it would ‘inconvenience’ some people.

McArthur said, “We realise that this change will inconvenience those consumers who use credit cards responsibly but we are satisfied that reducing the risk of harm to other consumers means that action must be taken”. It was an opinion backed up by Helen Whatley, the Culture Minister. She said, “Whilst millions gamble responsibly, I have also met people whose lives have been turned upside down by gambling addiction”.

Why It Matters To Revolut

Revolut has been a good way for gamblers to monitor their spending on account of the fact that it is a pre-paid card. That means that funding has to be added to the card before it can be spent, which is entirely different to credit cards. Credit cards work by extending people credit, hence the name, that needs to be paid off at some point in the future. That’s why it’s far easier for people to get themselves into debt using credit cards when gambling.

The use of Revolut gave people the ability to only spend what they could afford to, not only because they’d need to add the money to the card but also because it gave mobile notifications when something was spent and the card could be frozen. That it will also be affected by the ban on credit cards because Revolut uses Mastercard for the financial side of its business will therefore cause trouble for people who will have been using it to monitor their gambling.

But Doesn’t Revolut Have a Banking Licence?

Revolut is quick to point out that, legally, the business is currently an ‘electronic money institution’. They can handle money and facilitate any business transactions that customers may wish to carry out, but there are certain financial services that the company is unable to offer. Your money is still protected, of course, and any funds entered into an account with them are safeguarded in the same manner as traditional banks, they just aren’t one.

Or at least they’re not yet. In 2018 the company was granted an EU banking licence courtesy of the European Central Bank, but Revolut doesn’t yet have a UK banking licence. When it does, customers may well then be able to start using their Revolut card for the purposes of adding money to a betting account, but without the licence they’re essentially just operating as a credit card. For now, though, you’ll need to use a different card for deposits.