Hot on the heels of Caesar Entertainment’s agreement to buy William Hill for £3.7 billion, another betting company with ties to the British high street has become the subject of a takeover bid from a US-based company. MGM Resorts, the casino giant from the United States of America, has made an offer of $11 billion, or £8.1 billion, to buy Entain, the parent company of the bookmaker Ladbrokes.

Hot on the heels of Caesar Entertainment’s agreement to buy William Hill for £3.7 billion, another betting company with ties to the British high street has become the subject of a takeover bid from a US-based company. MGM Resorts, the casino giant from the United States of America, has made an offer of $11 billion, or £8.1 billion, to buy Entain, the parent company of the bookmaker Ladbrokes.

As well as owning Ladbrokes, Entain also counts numerous online sports betting and gambling brands as companies that come under its umbrella. This includes the likes of PartyPoker and Foxy Bingo, as well as the bookmaker Coral and the bingo brand Gala. MGM and Entain already have a relationship thanks to a joint-venture between the two businesses known as Roar Digital.

The Current Arrangement Between MGM and Entain

In July of 2020 it was confirmed that a second round of investment would take place for Roar Digital, the joint-venture between MGM Resorts and the company that was then known as GVC Holdings. It took the business’s total funding to $450 million after an initial investment of $200 million, both companies taking a 50% stake. At the time, the Chief Executive Officer of GVC, Kenny Alexander, was quick to praise the move.

He described it as the “most important and exciting” investment that GVC Holdings had ever made, believing that the venture could achieve” long-term market leadership”. Roar Digital expanded across the United States of America, with the aim of reaching eleven states by the end of 2020 courtesy of the BetMGM and PartyPoker brands, with market access agreements in place in nineteen states in total.

The original aim of the business was to combing the ‘best of MGM Resorts and GVC’, according to Roar Digital’s Chief Executive Officer, Adam Greenblatt. It now looks as though the move was used by MGM Resorts to establish a relationship with GVC Holdings, which rebranded as Entain late last year, in order to lay the foundations for a move that would overtake the smaller company.

Why MGM Wants To Buy Entain

the move from MGM Resorts to buy Entain comes in the wake of a similar takeover of William Hill by Caesars Entertainment. In both cases the moves have been prompted by the change in legislation in the United States of America in respect of sports betting. Though both Caesars Entertainment and MGM Resorts are well-known in the US from a gambling point of view, neither have a huge experience of sports betting.

By moving to takeover Entain, MGM Resorts is positioning itself to essentially jump the queue when it comes to setting itself up to take advantage of the new legislation in America. As is usually the case in the United States, each individual state can now come up with its own rules and regulations around betting, with many moving to legalise it for both in-person and mobile bettors.

The arrival of legal sports betting in America was always likely to fuel deals across the Atlantic, thanks in no small part to Britain’s more relaxed, yet still well licensed, betting rules. UK-based firms have both the technology and the expertise to attract US companies, mainly in the hope that it will help them to get straight to the point of offering successful betting practices to potential customers.

The Deal ‘Undervalues’ Entain

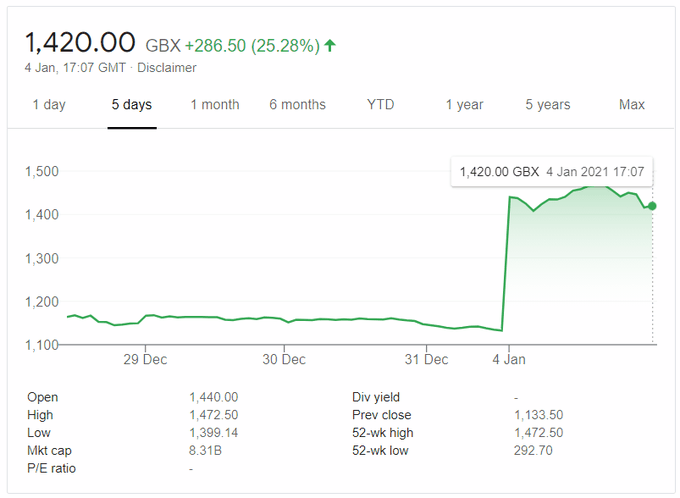

The offer of £13.83 per share from MGM Resorts was rejected by Entain, who believe that it undervalues both the company in its current form and its future prospects. It was a feeling confirmed by the market, with the company’s share price rising by more than a quarter to £14.32 on Monday morning. That seemed to suggest that traders think MGM Resorts will return with a higher offer.

Entain Share Price on the 4th January 2021 Courtesy of Google Finance

It appears as though US casinos were no longer satisfied with sharing the spoils available to them in the United States with British companies, instead preferring to buy out the British partners where possible. According to the head of European markets at Eilers & Krejcik Gaming, Alun Bowden, it makes sense to spend money on obtaining the know-how of the industry that is already possessed by British firms.

It makes sense for Entain to push for more money from MGM Resorts, given the fact that the state of California alone is worth more than the entire UK market. If MGM really wants to gain its know-how then it will have to pay for it. Darin Oliver is the Managing Director of Simply Alpha Capital and believes that the offer from MGM Resorts does indeed undervalue Entain.

Of Entain, he said, “It’s perfect for a US gambling operator to acquire since it’s likely to not have any dirty laundry in it. It’s the last man standing in that department…The sports betting market in the US is going crazy. There are limited entrants, the valuations are very high and there’s a belief that you need to get in early and establish spots. Covid hasn’t been a drag because the market sees it as being a temporary thing that won’t have an impact on behaviours.”