Every time that the British government releases its budget, companies and industries around the country brace themselves to see whether or not they’ll be affected. When we all sit and watch the news the spin that the government puts on the budget invariably sounds like it’s the best thing ever and that money will be pouring into our pocket in no time. That may well be the case for some, of course, but for many it’s a matter of wondering how they’ll be affected, if at all, and what they can do about it.

Every time that the British government releases its budget, companies and industries around the country brace themselves to see whether or not they’ll be affected. When we all sit and watch the news the spin that the government puts on the budget invariably sounds like it’s the best thing ever and that money will be pouring into our pocket in no time. That may well be the case for some, of course, but for many it’s a matter of wondering how they’ll be affected, if at all, and what they can do about it.

This year the Chancellor of the Exchequer has announced that the Remote Gaming Duty will be increased from 15% to 21%; a move that will become effective from the first of October 2019. Philip Hammond confirmed that the move was an attempt to offset the reduced about of tax that the government will be taking from gambling operations in the future because of the decision to reduce the maximum stake on Fixed Odds Betting Terminals, meaning that the new tax will act as something of a double-whammy for bookmakers who were already poised to love a significant amount of money.

The Link To FOBTs

AlexRotenberg / bigstock.com

I’ve written about the reduction in Fixed Odds Betting Terminals elsewhere on this site, so I’m not going to go over all of the old ground here. Sufficed to say, though, that the confirmation from the government that the maximum stake would be reduced to £2 was seen by the gambling industry as being a real kick in the teeth. One of the problems that bookmakers have got when it comes to sorting out their budget, however, is that exactly when the cut is going to kick in hasn’t yet been decided.

Originally it was intended that the stake cut would be from April 2020, then it was decided to delay that move by twelve months before changing that once more to mean that it will occur in October of 2019. The Chancellor didn’t give any indication during his budget speech as to whether or not this date had been locked in, but many are assuming that it will occur at the same time as the new rate of tax for the Remote Gaming Duty, given that that has been put in place in order to allow the government to meet the shortfall in revenue.

It’s Not The First Tax Increase For Remote Gaming

There was a sense of relief in some sectors of the gambling industry when Mr. Hammond’s budget was announced, with many having been concerned that the RGD rate might go up by as much as 25%; just the rumour of that being the case cause many gambling firms to see their share price drop in the week before the budget. For others, though, their was anger at the fact that this was the third tax increase for online operators in the course of four years.

The British government implemented a 15% Point Of Consumption Tax in December of 2014, then in March 2016 the then-Chancellor of the Exchequer George Osbourne announced plans to impose a 15% tax on free and discounted bets placed on online sports and racing. In December of 2016 the government actually chose to revise its initial idea, but operators were nevertheless annoyed that they had been hit with yet another hike in tax. Land-based operators had also been hit with a rise back in 2014.

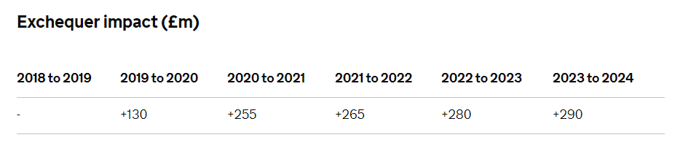

The Cost To Bookies

One of the key questions that bookmakers will want an answer to is how much the new rate of tax is going to cost them. The answer depends on who you listen to, with analysts estimating that a Remote Gaming Duty of 20% is likely to cost around £200 million per year, whilst the government’s own sums on the matter say that a 21% rate of tax will result in an extra tax revenue of £130 million when the 2019-2020 budget is released. That will rise to £255 million in 2020-2021 and then around £290 million two years later.

Whilst the government suggested that the impact on gambling operators of the RGD increase will be ‘negligible’, you only need to look at the numbers to realise that that is unlikely to be true. The government will lose around £1.15 billion over the course of five years because of the cut to FOBT stakes, which will also hit bookmakers. The budget can make that money up thanks to the £1.22 billion raised by the change in the RGD tax over the same period of time, but that will obviously also hit gambling companies. Admittedly it will only by those with both high street stores that can house Fixed Odds Betting Terminals and an online presence, but that is still a big chunk of the industry.

What Will The RGD Affect?

The most important thing to realise is that the Remote Gaming Duty will not have any impact on income made on the majority of betting, with wagers placed on racing and sports still being taxed at 15%. The RGD will only be for games of chance played with gambling operators, which includes the likes of slot machines and roulette.

The most important thing to realise is that the Remote Gaming Duty will not have any impact on income made on the majority of betting, with wagers placed on racing and sports still being taxed at 15%. The RGD will only be for games of chance played with gambling operators, which includes the likes of slot machines and roulette.

Campaigners against Fixed Odds Betting Terminals couldn’t care less which games are affected, of course, being angry with the government for not choosing to implement the stake cut from April of next year. However, the Association Of British Bookmakers believes that the delay in implementing the cut could allow the betting shop sector of the industry enough time to save jobs.

The ABB said, “Thousands of jobs will be lost and shops closed on the high street as a result of the announced reduction in maximum stake. The implementation period will not avert most of the job losses but it will give a small amount of time for businesses to redeploy staff and save jobs where possible”.