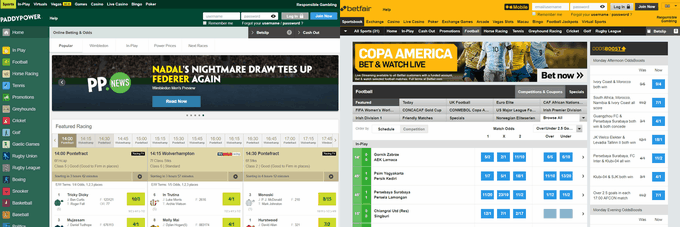

Betfair and Paddy Power merged to create one company in 2016: the imaginatively named Paddy Power Betfair. Whilst they’ve continued to exist as separate entities since then, with the Irish bookmaker Paddy Power continuing with their ploy of controversial marketing in order to make the headlines and Betfair having added a traditional sportsbook to their better-known exchange betting market, they have also taken advantage of the merger in terms of how they both operate.

Betfair and Paddy Power merged to create one company in 2016: the imaginatively named Paddy Power Betfair. Whilst they’ve continued to exist as separate entities since then, with the Irish bookmaker Paddy Power continuing with their ploy of controversial marketing in order to make the headlines and Betfair having added a traditional sportsbook to their better-known exchange betting market, they have also taken advantage of the merger in terms of how they both operate.

If you’re a Betfair customer, for example, then you can go into a Paddy Power shop on the high street and pay money into your Betfair account there, should you wish to. Now they will continue to operate the betting side of the business as separate entities and under their current brand names, but the overall parent company is changing its name to become Flutter Entertainment plc. The announcement came alongside the group releasing its annual results, in which it confirmed a 7% rise on its performance in 2018 to £1.9 billion.

The Group’s 2018 Performance Was ‘Good’

Peter Jackson, the Chief Executive of Paddy Power Betfair, said that he was ‘delighted’ by the group’s performance at a time when the gambling industry as a whole was having some difficulties. As well as the the cut in the maximum stakes applicable to Fixed Odds Betting Terminals from £100 to £2, the betting industry had also had to cope with a change to the way in which they were taxed in the United Kingdom.

That’s in stark contrast to the way in which the Australian government taxes betting companies, which tends to favour larger corporations such as Paddy Power Betfair. Given that the company, which will be known as Flutter Entertainment moving forward, has been positioning itself to take advantage of the growth in the Australian betting market as well as the burgeoning one in the United States of America. Indeed, Paddy Power Betfair purchased FanDuel in 2018 specifically in order to gain a foothold in the American betting market, the shift in which Jackson feels is the biggest thing to happen to the gambling industry since online betting.

The Name Change Is Aimed At The US Market

The Supreme Court’s decision to to let individual states decide for themselves whether or not online betting should be legal there has seen the major players in the industry fall over themselves to try to gain a slice of the sport betting pie in one of the biggest markets on the planet. The Court’s decision overturned one that had been made in 1992 on the grounds of it being unconstitutional. Paddy Power Betfair bought FanDuel in order to put themselves in the best possible position to take advantage of the growth of this relatively young market.

FanDuel is a company that boasts 8 million customers in the United States, meaning that it is recognised as a sports brand around the country. Jackson made reference to them, along with Paddy Power Betfair’s ‘betting expertise’ as part of the reason why the partnership had a good chance of succeeding. He said that the partnership allowed the company to access the market ‘very well’. The decision to rebrand as Flutter Entertainment meant that they could go into the US market with a new name that they could ensure they get brand recognition for.

The ‘Flutter’ Title Was One Of The First Ever Betting Exchanges

Flutter launched in the same year as Betfair, backed by £30 million worth of investment. It was the brainchild of Josh Hannah and Vince Minical and many preferred using it to its more famous cousin on account of the fact that it promised a flat commission rate of 2.5% as well as betting odds in fractional form. That stood in strong contrast to Betfair that used the decimal odds system and charged between 4 and 5% in commission. Despite being popular with a certain section of punters, however, Betfair announced a merger with Flutter in Christmas of 2001.

The ‘merger’ actually turned out to be a complete takeover, with Betfair owning 98% of the company by January of the following year. Quite why Flutter allowed the takeover, considering they were making headway in the market and had a website that many thought was smoother and more intuitive than their rivals, isn’t clear, but the fact that Hannah remained on the board probably goes someway to explaining the decision. It’s also believed that the company racked up debts during the early part of its existence, leaving it vulnerable to just that sort of takeover.

That the two men behind the launch of Flutter were Americans probably tells you part of the reason for the decision to take on the moniker before Paddy Power Betfair attempts to launch in the United States in a big way. It was the opposite of Betfair, which had been founded by Edward Wray and Andrew Black, the latter being the grandson of a Tory MP who had actually campaigned against the expansion of gambling in the United Kingdom.

Paddy Power & Betfair Will Remain Largely Unchanged

Paddy Power and Betfair are well-known as individual companies meaning it is unlikely that it will be worth the while of the parent company to change their names for the UK market. Instead they will keep operating in the same way that they always have, merely taking advantage of the parent company’s increased reputation on a global scale. Speaking about the success of the Paddy Power side of the company Jackson referred to the ‘classic marketing’ that they had used to ‘regain their mojo’ in 2018. He said, “With a growing portfolio of brands, we plan to rename the Group as Flutter Entertainment plc. There are no plans to use this historical name for consumers”.

Betfair, meanwhile, has remained popular with punters that like to bet against each other on the exchange, in spite of the fact that a number of mainstream bookmakers have also started offering their own exchanges to bettors in order to try to steal some business back off Betfair. It means that the new Flutter Entertainment parent company will have the perfect two-pronged approach moving forward, with the brand recognition of Paddy Power and the much-loved format of Betfair working in tandem and alongside FanDuel and other ‘challenger brands’ to help the company crack the American market at the same time that it continues to work with customers in the UK.