One of the ways in which bookmakers keep themselves relevant is by constantly evolving, which often involves purchasing rival companies in order to cover perceived weaknesses in different areas of their business. That’s what William Hill have decided to do by offering to purchase the Swedish-listed gambling operator Mr Green in a bid believed to be worth around £242 million.

One of the ways in which bookmakers keep themselves relevant is by constantly evolving, which often involves purchasing rival companies in order to cover perceived weaknesses in different areas of their business. That’s what William Hill have decided to do by offering to purchase the Swedish-listed gambling operator Mr Green in a bid believed to be worth around £242 million.

There are numerous reasons as to why this would be a good move by William Hill, with the main one being that it would allow the company to strengthen the digital side of the business. This might prove to be particularly helpful if the United Kingdom goes ahead with its plan to leave the European Union in 2019. William Hill remain based in London, meaning that a move to takeover a company based in Europe will reduce its dependency on the British market at a time when regulations in the UK are likely to be tightened.

An ‘International Hub’ For William Hill

It would be untrue to suggest that William Hill’s only business comes from the UK at present, but it’s definitely the case that the majority of it does. Should the UK continue down the path of exiting the European Union, which seems to be the likely course of action at this point in time, then William Hill’s access to that market will be severely limited. Mr Green, on the other hand, operates in thirteen markets and has a hub in the European Union member state of Malta.

William Hill’s main area of operations at present is Gibraltar, but how useful the British Overseas Territory will be in the event of a decision to pull out of the European Union remains to be seen. Philip Bowcock, the Chief Executive Officer of William Hill, told Reuters that the deal would provide the company with an ‘international hub’ that could be a big help in the wake of Brexit.

A New Focus on Online Operations

The takeover, should it go ahead, will also give William Hill a bit more stability when it comes to their online operation, which could be crucial when the Fixed Odds Betting Terminal maximum stake cut comes in next year. William Hill are one of four major bookmakers that has high street stores that will be severely affected by the reduction in stake from £10 to £2, so they are likely to become more dependent on the online side of their business until the industry levels itself out in the wake of the stake reduction. Indeed, the stake cut is likely to see as many as nine hundred William Hill stores in danger of closing.

In the 2018-2019 budget the Chancellor of the Exchequer confirmed that the Remote Gaming Duty will increase by 6% from 15% to 21%. An increase in the number of countries that William Hill operates in will allow them to offset any potential loss, so the fact that Mr Green has remote licences in the likes of Ireland, Latvia, Italy and Denmark as well as Britain will be seen as important and is a big reason the company is so keen on the takeover.

William Hill Share Price Jumps 8%

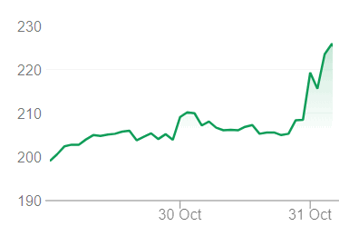

William Hill Share Price Movement After Bid Announcement

News of the proposed takeover caused William Hill’s share price to go up by over 8% on the morning that it was announced, whilst Mr Green’s shares went up an impressive 47% to 68.40 Swedish crowns. Founded in 2007, Mr Green has grown in size and importance in the decade or so since, so shareholders weren’t slow to approve the William Hill bid.

The shareholders own more than 40% of Mr Green & Co and they’ve been delighted to see the company grow over the past few years. They reported a revenue increase of more than 51% in the third quarter of this year, which is another part of what attracted William Hill to make an offer for a takeover. That Mr Green also operates the brand known as Redbet also didn’t go unnoticed, which will allow William Hill to increase both their digital business and their footprint in Europe.

Expanding Away From The UK Market

Going back to William Hill’s CEO Philip Bowcock, he spoke to the Racing Post and said, “We know we are heavily reliant on the UK market and what we need to think about is how we diversify to make sure we get more revenues from other markets. This provides that and takes our international revenues from about 14 per cent to about 21 per cent”. He also spoke about the fact that Mr Green is being seen as a ‘significant growth engine’, with the company being the leading casino brand in Germany and the third best in Austria.

Despite the success of the Mr Green casino operation, however, it is unquestionably the ability to use the company as a pre-made hub in Europe that is attracting William Hill to the move. Bowcock said, “what we will do is drop our international operations straight into their Malta hub, where they have in excess of 300 people. I think is is a sensibly priced transaction which gives us significant opportunities to grow internationally and gives us that hub in Malta”.

Combining The Sportsbook And Casino

One of the big attractions for William Hill aside from the European hub that they’ll be buying is the ability to increase the number of sportsbook users in Mr Green’s already existing customer base. At present, around 90% of the company’s revenue comes from casino users and only 10% is via sports betting, which an area that William Hill consider to be their bread and butter.

If the takeover goes ahead then William Hill will not only be getting a base in Europe for after Brexit but will also have the opportunity to increase revenue, with Bowcock saying that they can use their ‘sportsbook expertise’ to ‘cross sell’. Ulrik Bengtsson, William Hill’s Chief Digital Officer, will be responsible for the integration of Mr Green with William Hill’s existing operations. He already has solid experience of working with a Nordic gaming business that is mostly based online thanks to his time with Betsson, so his knowledge mixed with William Hill’s own history could see the Mr Green business grow exponentially.