You have to admire the Gambling Commission’s commitment to constantly ensuring that they do what they can to protect people and stop them from getting into any real financial trouble. The organisation consistently monitors the industry and changes and adopts its rules accordingly. We’ve seen that occur in the past, with the regulator fining companies that have not done enough to help stop users that have self-excluded from being able to access their accounts, for example.

You have to admire the Gambling Commission’s commitment to constantly ensuring that they do what they can to protect people and stop them from getting into any real financial trouble. The organisation consistently monitors the industry and changes and adopts its rules accordingly. We’ve seen that occur in the past, with the regulator fining companies that have not done enough to help stop users that have self-excluded from being able to access their accounts, for example.

Now the independent regulator is considering introducing a ban on the use of credit cards for gambling online. Interestingly, the suggestion to introduce the ban came within a Gambling Commission report entitled ‘Gambling Commission Makes Online Gambling Safer’, rather than because they’re specifically hoping to reduce the debt that customers might get themselves in to – not that the two things are mutually exclusive, of course. Here I’ll explain why the Commission has decided it might be the way forward, as well as what the ban will mean for customers.

Why Ban Credit Cards?

The obvious question when reading about the Gambling Commission’s consideration of banning credit cards is ‘why?’ The answer is quite simple, really, summed up by the Commission’s declaration that doing so could ‘increases the risk that consumers will gamble more than they can afford’. Obviously if customers gamble using debit cards that take money directly from their current accounts then they’re either using money that they have in their account or else money that’s from an overdraft that’s been pre-approved by their bank.

Excerpt from Gambling Commission Review of online gambling, March 2018

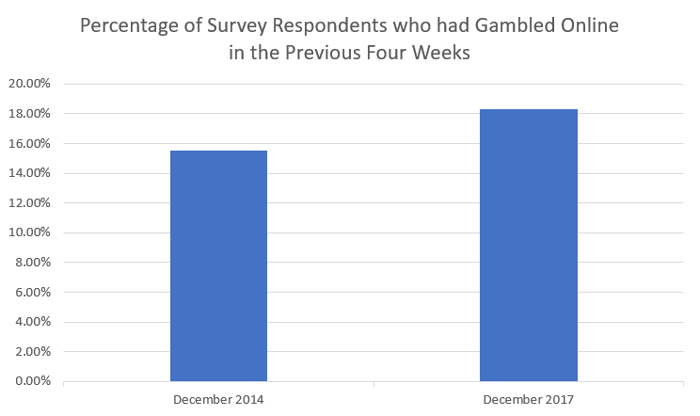

Credit cards, on the other hand, allow consumers to use money that they don’t actually have but have made a commitment to pay back over a certain period of time. Should those people be problem gamblers then there’s no guarantee that they’ll be able to pay it back, resulting in an increased chance that they will go into debt in order to fund their betting habit. Given that the report reveals that the number of people partaking in online gambling has increased from 15.5% to 18.3%, it’s entirely possible that the Commission felt that this increase in users brings with it the possibility that some of these new users will do exactly that.

Interestingly, one of the Gambling Commission’s other ‘proposed changes’ suggested in the report was to ‘Ensure operators set limits on consumers’ spending until affordability checks have been conducted’. In other words, doing their utmost to make sure that bookmakers’s customers can afford to place bets and cope with potential losses. They also suggested ‘Strengthening requirements to interact with consumers who may be experiencing, or are at risk of developing, problems with their gambling’, which you have to assume includes customers that are using credit cards as a means of funding their online activities.

Debt & Gambling

As you would perhaps expect, the majority of people are win favour of the possibility of the Gambling Commission banning the use of credit cards to make deposits into online gambling accounts. The Labour MP Carolyn Harris has long campaigned for safer gambling and admits that the use of credit cards ‘terrifies’ her. She said, “Gambling debts already are a major concern not just for the individual, but for their family who pay the price of the consequences”.

As you would perhaps expect, the majority of people are win favour of the possibility of the Gambling Commission banning the use of credit cards to make deposits into online gambling accounts. The Labour MP Carolyn Harris has long campaigned for safer gambling and admits that the use of credit cards ‘terrifies’ her. She said, “Gambling debts already are a major concern not just for the individual, but for their family who pay the price of the consequences”.

She isn’t the only person who feels that this is a move in the right direction. Her Labour Party colleague Tom Watson believes that merely considering banning credit cards isn’t enough and that the Gambling Commission needs to take much stronger action on the matter. He said, “There’s a strong argument that we shouldn’t use debt to finance gambling and therefore we should be thinking seriously about whether people should be able to use credit cards to gamble at all”.

Perhaps even more noteworthy is the fact that there seems to be cross-party support for the Gambling Commission’s considerations. The Conservative MP Tracey Crouch, who is the Minister For Sport & Civil Society, also suggested that the new proposals would ‘strengthen the controls already in place’. Marc Etches, who is the chief executive of GambleAware, stated that banning the use of credit cards with online gambling could be ‘hugely beneficial in protecting the vulnerable’, given that the use of credit over money that you’ve actually got in your account ‘significantly increases the risk of gambling more than you can afford’.

Would Banning Credit Cards Stop Gambling on Credit?

According to betting operators, as much as 20% of online deposits could be made using credit cards, which is a decent chunk of the £4.7 billion that the online gambling industry benefited from in 2017. That’s around a ten percent increase on last year and is no small change when you consider that the online sector doesn’t include money raised from the National Lottery or other similar lotteries that you can play online.

According to betting operators, as much as 20% of online deposits could be made using credit cards, which is a decent chunk of the £4.7 billion that the online gambling industry benefited from in 2017. That’s around a ten percent increase on last year and is no small change when you consider that the online sector doesn’t include money raised from the National Lottery or other similar lotteries that you can play online.

Up to twenty percent is also enough of the overall intake of deposits for the Gambling Commission to consider what method people might use if they can’t use credit cards. That includes the possibility of consumers turning to payday lenders in order to secure short-term loans that will likely have a significantly increased APR over credit cards. The Commission’s report suggested that they realised such short-term loans were a possible option for customers that really want to gamble, the feeling is that the chance of them using credit cards were far more likely and ‘particularly acute’. It will be interesting to see what the Commission decides to do in the coming months.